Introduction – What Is the Fidelity Core Position?

Your “core position” at Fidelity simply refers to where your uninvested cash goes inside your account. For example, if you have 75% in an S&P 500 index fund like VOO and 25% uninvested cash, that 25% cash will automatically go into whatever fund or vehicle you select as your “core position.”

The core position basically acts as a wallet. When you buy something in your Fidelity account like a stock, you pay for it with money from that wallet. When you sell something, proceeds go into that wallet. The core position also facilitates transactions like check processing, electronic funds transfers, direct deposits, wire transfers, authorized credit cards, and other payments. There is no minimum balance requirement for the core position.

You have several options for how exactly that cash is held, which is why you're on this page in the first place.

First, let's get the obligatory reminder out of the way that market timing is usually more harmful than helpful, and DCA is inferior to investing a lump sum on average, so you probably shouldn't be holding much actual cash in the first place. But note that I'm not referring to something like T-bills or short-term government bonds, which are considered a “cash equivalent,” and which may be a perfectly sensible investment depending on your personal goals, time horizon, and risk tolerance. While several of these funds do indeed have allocations to T-bills, none of these options we're discussing here for the core position would be considered a dedicated T-bills fund.

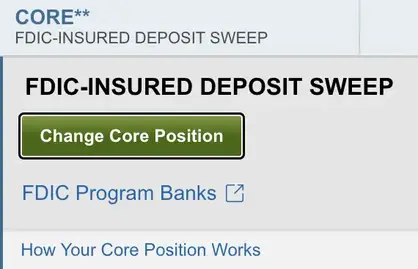

By the way, here's the section and button you're looking for in your Fidelity account:

Now that that's out of the way, let's compare SPAXX, FZFXX, FDIC, FCASH, and FDRXX.

SPAXX vs. FZFXX, FDIC, FCASH, & FDRXX

So which Fidelity core position should you go with? Let's talk about 'em.

SPAXX – Fidelity Government Money Market Fund

As the name suggests, SPAXX is what's called a money market fund. This is a fund that holds ultra-short-term instruments that are considered cash equivalents – such as CDs, commercial paper, and repo agreements – in order to pay what is usually a tiny interest rate.

This type of fund usually pays a marginally higher interest rate than that of a plain ol' savings account at a bank. The tradeoff, of course, is that a money market fund is not insured.

SPAXX is specifically collateralized by government securities, and would thus be considered safer than a broader money market fund that includes corporate debt. If we look at the holdings of SPAXX, it's mostly U.S. government repurchase agreements, followed by U.S. Treasury Bills and U.S. Treasury Coupons.

We would expect a fund like this to have volatility no greater than about 3% in either direction. At the time of writing, SPAXX has a 7-day SEC yield of 5.00%.

You may see SPRXX instead of SPAXX. They're both very similar and should have the same fee, but SPRXX is slightly broader in its scope of debt instruments. As such, SPRXX may pay a higher yield than SPAXX.

SPAXX and all the money market funds on this list are insured by the SIPC, which stands for Securities Investor Protection Corporation, up to $500,000 in the event of financial troubles with the brokerage firm. You've probably heard of FDIC insurance for savings accounts. SIPC is basically the FDIC of investment securities.

FDIC – FDIC-Insured Deposit Sweep Program

As the name suggests, this is simply an FDIC-insured vehicle into which cash is “swept” inside the account. FDIC stands for Federal Deposit Insurance Corporation, which is quite literally the organization that insures your cash deposits up to $250,000. This is basically a true savings account like you'd have at your regular bank. In fact, Fidelity actually spreads your deposits here among several banks; that's why it's called a “program” and is not an actual investable fund.

As a result, your cash balances will be FDIC-insured even if they exceed $250,000. In the event of a lack of capacity or availability from program banks, any excess cash will be swept into the Fidelity Government Money Market Class S mutual fund, for which the ticker is FZSXX. Fidelity refers to this as the “Money Market Overflow.” At the time of this video, this mutual fund has a 7-day SEC yield of 5.00%.

Because this is basically a plain vanilla savings account, we'd expect it to pay less than the other options on this list, but it can be considered comparatively less risky and less volatile. With this program, your cash is not exposed to any kind of market risk like with others on this list. That said, “less risky” in this context just means we're basically going from extremely safe to riskless.

As of January 2024, this FDIC cash sweep program has an interest rate of 2.69% and also a fee of 0.01%.

FCASH

FCASH is another option you'll see in your taxable brokerage account. Note that this is going to be the default option inside your account. This is a free credit balance from Fidelity that earns interest. At the time of writing, its interest rate is 2.69%.

FDRXX – Fidelity Government Cash Reserves

Like SPAXX, FDRXX is another U.S. government money market fund. For all intents and purposes, it is basically an older version of SPAXX. Their holdings are nearly identical and they have nearly the same yield and the same historical returns.

FDRXX launched in 1979 and has a 7-day SEC yield of 5.02%.

FZFXX – Fidelity Treasury Money Market Fund

You may encounter FZFXX as an option in your taxable account. It's basically the same as SPAXX and FDRXX except it does not have the 10% or so in agency securities. This one is entirely U.S. Treasury securities.

In that sense, it is slightly more tax-efficient and thus may appear as a choice for your taxable brokerage account with Fidelity. Its yield should be roughly the same as SPAXX. Right now it is exactly the same as SPAXX at 5.00%.

Conclusion

Don't overthink your Fidelity Core Position.

If you are willing to sacrifice return/yield for zero volatility and virtual risklessness, go with the FDIC-insured cash sweep program. If, however, you want a very safe parking garage for cash that would be expected to have a positive nominal return, a government money market fund is a fine choice. Remember too that those money market funds are still SIPC-insured up to $500,000.

For all intents and purposes, the 3 money market funds on this list are nearly the same thing. Out of these, you may simply want to aim for the highest yield.

You can also switch between them at any point based on whichever one is paying the most, but this basically comes down to comparing the money market funds and the FDIC program (banks). You can obviously change your core position at any time online yourself, but if any of this seems overwhelming, you can also call a Fidelity representative to do it for you at 800-544-6666.

Conveniently, interest from the government securities will also be state-tax-exempt.

At the end of the day, this is definitely not a decision to lose sleep over.

Comments

Post a Comment

https://gengwg.blogspot.com/