Lazy portfolios are designed to perform well in most market conditions. Most contain a small number of low-cost funds that are easy to rebalance. They are "lazy" in that the investor can maintain the same asset allocation for an extended period of time, as they generally contain 30-40% bonds, suitable for most pre-retirement investors.[note 1]

Note: Historical performance for many of the "lazy portfolios" is available on our site's blog. See Portfolios - Financial Page.

Two-fund portfolio

It is possible to retain access to the broad US and International markets, as well as bonds, using only two funds. Rick Ferri has proposed a two-fund portfolio containing the total world stock market, and a diversified US bond market index fund as follows.[1] Expense ratios are shown in parentheses.

| % Allocation |

Asset Class | Using Mutual Funds | Using ETFs | |

|---|---|---|---|---|

| Vanguard | Vanguard | SPDR | ||

| 60% | Total World Stock Market | VTWAX (.10%) | VT (.08%) | SPGM (.09%) |

| 40% | Total Bond Market | VBTLX (.05%) | BND (.035%) | SPAB (.03%) |

Three-fund lazy portfolios

There are a number of popular authors and columnists who have suggested 3-fund lazy portfolios. These typically consist of three equal parts of bonds (total bond market or TIPS), total US market and total international market. Note that while the "% allocation" is different from those listed below, these funds typically make up the core of Vanguard's Target Retirement and Lifestrategy funds.[note 2] Expense ratios are shown in parentheses.

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

In addition, consider that there are several close alternatives to these funds, especially when purchasing through Vanguard. For example, consider that the "Vanguard Inflation-Protected Securities Fund" also has a short term alternative, "Vanguard Short-Term Inflation-Protected Securities Index Fund" (tickers VTIPX or VTAPX) which can offer slightly less volatility in NAV.

Core four portfolios

As proposed by Rick Ferri on the Bogleheads® forum, the Core Four are four funds which form the "cornerstone" of a portfolio. Low-cost, total market fund examples are shown below (with expense ratios in parantheses).

| Asset Class | Using Mutual Funds |

|

Using ETFs | |||

|---|---|---|---|---|---|---|

| Vanguard | Fidelity | Schwab[note 4] | Vanguard | iShares | ||

| Total US Stock Market | VTSAX (.04%) | FSKAX (.015%) | SWTSX (.03%) | VTI (.03%) | ITOT (.03%) | |

| Total International Stock Market | VTIAX (.11%) | FTIHX (.06%) | SWISX (.06%) | VXUS (.08%) | IXUS (.09%) | |

| Total Bond Market | VBTLX (.05%) | FXNAX (.025%) | SWAGX (.04%) | BND (.035%) | AGG (.04%) | |

| Real Estate Investment Trusts (REIT) | VGSLX (.12%) | FSRNX (.07%) | --- [note 7] | VNQ (.12%) | USRT (.08%) | |

Rick proposes that investors first determine their bond allocation. With the remaining funds, allocate 50% to US stock, 40% to international and 10% to REIT.[3] For example, for 60/40 and 80/20 portfolios, you would end up with the following [1]:

Rick stresses that the exact allocation percentages aren't important, to the nearest 5% is fine.[4]

The core-four is just a low cost foundation for your portfolio. You could add a slice of value stocks (US and/or International). You could split the bond portion between Treasury Inflation Protected Securities and nominal bonds, which would result in a slightly more conservative version of David Swensen's model portfolio (less international stock and less REIT, but otherwise the same four base funds plus TIPS.

More lazy portfolios

Beyond the simple 3- and 4-fund lazy portfolios are more complex portfolios. These are still "lazy" in that they contain enough bonds (typically 30-40%) to allow the investor to maintain the same AA for much of the accumulation phase of their lives. The more complex funds add REITs, and 'slice and dice' the US and/or International stocks, adding large and small value to the mix. It is worth noting that in some of the cases outlined below, a simpler portfolio may be able to accomplish similar goals. For example, a small and value tilt away from the market may be accomplished by adding a small cap value fund, thus 'tilting' from a total stock market fund.

Bill Schultheis's "Coffeehouse" portfolio

This simple 7-fund portfolio was made popular by Bill Schultheis' book The Coffeehouse Investor. He advocates 40% in a total market bond fund and 10% each in various stock funds. More information can be found at The Coffeehouse Investor. The Coffeehouse Portfolio contains only 10% international stocks (17% of total equities). It slices up the domestic portion, but uses a total international fund.[note 8]

|

| ||||||||||||||||||||||||||||||||||

William Bernstein's "Coward's" portfolio

William Bernstein is the author of several books including The Intelligent Asset Allocator and The Four Pillars of Investing. He introduced the Coward's Portfolio in 1996. The "coward" refers not to the investor's risk tolerance but to the strategy of hedging one's bets and having slices of a number of asset classes. This portfolio is similar to the Coffeehouse Portfolio except that short term bonds are used, and the international portion is divided into equal slices of Europe, Pacific and Emerging markets.

|

| ||||||||||||||||||||||||||||||||||||||||||

Frank Armstrong's "Ideal Index" portfolio

Frank Armstrong, author of The Informed Investor, proposed this portfolio for an MSN Money article. It contains a smaller allocation to bonds, and a much larger allocation to international stocks (in fact the equities, excluding REIT, are split 50/50 between domestic and international). Like Bernstein he advocates short term bonds. If the domestic slices were replaced by a total market fund, this portfolio would be very close to the 3-Fund portfolios, with a slice of REIT added.

|

| ||||||||||||||||||||||||||||||||||

David Swensen's lazy portfolio

David Swensen is CIO of Yale University and author of Unconventional Success. His lazy portfolio uses low-cost, tax-efficient total market funds, a healthy dose of real estate, and inflation-protected securities (TIPS).[5][note 9]

|

| ||||||||||||||||||||||||||||||||||||||

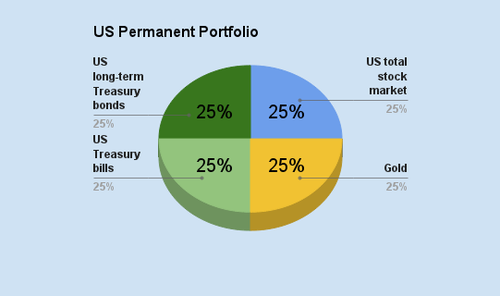

Permanent Portfolio

The Permanent Portfolio was devised by free-market investment analyst Harry Browne in the 1980s as a buy-and-hold portfolio that contains a healthy allocation to gold. The portfolio holds equal allocations of domestic stocks, gold, short-term treasury bonds, and long term treasury bonds.[6][note 10]

Forum members Craig Rowland and J. M. Lawson have written a book, 'The Permanent Portfolio: Harry Browne's Long-Term Investment Strategy, detailing every aspect of the Permanent Portfolio.

The portfolio can be implemented with an investment in a low cost US total stock market index fund, along with direct investments in gold bullion coins, US treasury bills, and US treasury bonds. It can also be implemented with low-cost exchange-traded funds. See Blackrock iShares for an ETF version of the portfolio.

|

| ||||||||||||||||||||||

可惜前面那么多年一直在为生

ReplyDelete活,身份奔忙,无暇顾及投资。现在看来,投资越早越好。而且就躺平死皮即可,不用

任何花哨,也不用加杠杆。

ReplyDelete租金相当于股票的分红

房价上涨相当于高科技股价上涨