Kids Can Invest Too

First of all, we’re talking about kids under 18 here. Adult children are adults. They can buy I Bonds in the same way as any other adult. If your adult children don’t have spare cash you can give them money and they can use the money to buy I Bonds (or anything else). If you’d like to buy I Bonds and then give the bonds to them as a gift, that’s buying as a gift. We’ll cover buying I Bonds as a gift in a different post.

Kids can invest too, not only in I Bonds but also in other investments such as mutual funds, ETFs, etc. Because kids can’t legally agree to terms and conditions when they’re a minor, an adult has to open an account for them and act as a custodian. These accounts are typically called UTMA accounts, which are named after the law that governs custodial accounts: Uniform Transfer to Minors Act.

If you already have UTMA accounts for your kids and you’re just diversifying part of their investments into I Bonds, you can skip some of the discussion on whether you should open an account in your kid’s name in the first place.

Money In a Kid’s Name

Money in your kid’s name belongs to your kid. You’re only holding the money and investing on their behalf until your kid becomes an adult. Even if you gave the money to your kid to begin with, you can’t take the money back or spend it willy-nilly. You can spend money from the kid’s account but it has to be on something that specifically benefits the kid. Spending the money on their sports uniforms and equipment may be OK but not for general household expenses.

As the custodian, you can decide to invest your kid’s money in mutual funds, ETFs, or I Bonds. Once your kid becomes an adult, your duty as the custodian is over and you must turn over the investments to the kid. If they decide to blow the money on a Tesla or travel to Antarctica, that’s their prerogative.

529 Plan Is Better for College

If you intend to use the money for your kid’s college expenses, it’s probably better to put the money in a 529 plan than a custodial account. Depending on where you live, you may get a state tax deduction or credit for contributing to a 529 plan. Earnings in a 529 plan are tax-free when the money is distributed for qualified college expenses whereas earnings in a custodial account are taxable.

When the I Bonds are in the kid’s name, the interest is still taxable even if the bonds are cashed out for their college expenses. When the I Bonds are in a parent’s name, it’s possible that the interest is tax-free when they’re used for a child’s qualified college expenses. However, many high-income parents don’t meet the qualifying income limit to make it tax-free.

If your kid is still young, money in a 529 plan can be invested in stocks for possibly better returns whereas I Bonds at current rates only match inflation. When your kid is ready to go to college, money in a 529 plan is also treated more favorably in financial aid considerations than money in a custodial account.

Kiddie Tax

If the money isn’t for college expenses but for some other expenses specifically for the kid, there are some limited tax benefits to put the money under your kid’s name as opposed to keeping it in your own name.

When you redeem I Bonds under your kid’s name (either to transfer to a custodial account elsewhere or to spend specifically for their benefit), the accumulated interest is taxable. The first $1,100 in interest income covered by the kid’s standard deduction is tax-free. The tax on the next $1,100 is at the kid’s tax rate, which starts at 10% when they have no other income. The tax on interest income above $2,200 is at your tax rate, which would be the same had you kept the money in your own name.

So the tax benefit of putting money in your kid’s name is limited to the first $2,200 in investment income. Your kid pays a blended 5% on $2,200 versus you pay at your marginal tax rate. You need to file a tax return on behalf of your kid to realize the tax savings. The kid’s tax return is relatively simple when they don’t have other income. Downloaded tax software offers five federal e-files for this purpose.

Minor Linked Account

After considering the limitations of holding money in your kid’s name, the possibly better alternative of simply adding to their 529 plan, the limited tax benefits, and having to file a tax return for your kid, if you still want to buy I Bonds in your kid’s name, here’s how.

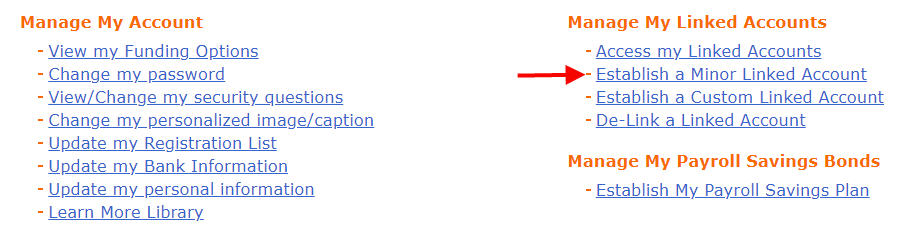

First, log in to your own TreasuryDirect account. Then to go ManageDirect. Find the link for “Establish a Minor Linked Account” on the right.

The fill out the required information (name, Social Security Number, date of birth, etc.). The primary bank account linked to your account is automatically linked to this Minor Linked Account for your kid.

Repeat the above if you’d like to create a Minor Linked Account for another kid.

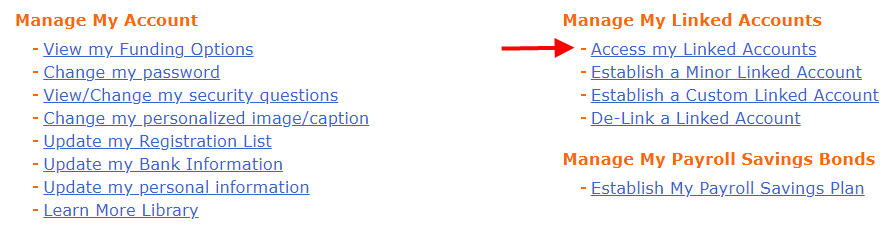

After the Minor Linked Account is created, you go into it by clicking on the “Access my Linked Accounts” link under ManageDirect.

Then you buy I Bonds as usual in each Minor Linked Account. The purchase limit is also $10,000 per kid per calendar year.

Cashing Out

When you cash out I Bonds from a Minor Linked Account for your kid, the money goes to the linked bank account. After that, you can transfer the money to a custodial account elsewhere for some other investments for your kid or spend the money on expenses that specifically benefit the kid.

Just like cashing out I Bonds in any other account, the accumulated interest is taxable to the kid in the year you cash out. TreasuryDirect will generate a 1099-INT form but it won’t send it by mail. You’ll have to remember to come into the Minor Linked Account and download or print the 1099 form. You use the 1099 form to file the tax return for your kid.

Reaching Adulthood

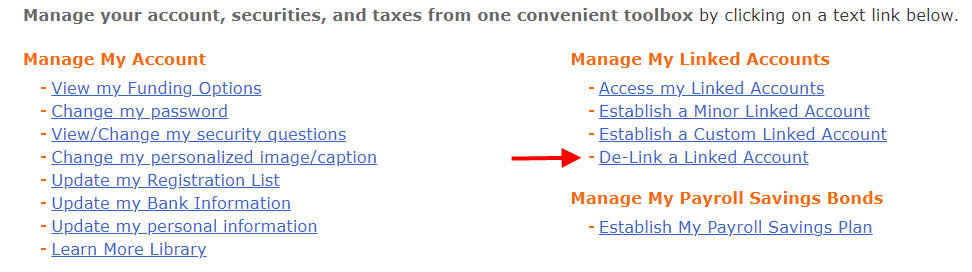

When your kid reaches 18, they can set up their own TreasuryDirect account as an adult. You “de-link” in ManageDirect and transfer the bonds in the Minor Linked Account to their adult account. They’ll take over from there.

Only moving the bonds from the Minor Linked Account to their adult account in TreasuryDirect doesn’t trigger taxes. Cashing out does.

***

Buying I Bonds in your kid’s name is relatively simple. The more important questions are:

- Do you want to give money to your kid in the first place, as opposed to adding to their 529 plan or keeping full control of the money in your own name?

- How much of your kid’s money should you invest in I Bonds that match inflation as opposed to in mutual funds and ETFs for long-term growth?

Remember money in your kid’s name belongs to the kid.

Comments

Post a Comment

https://gengwg.blogspot.com/