What Are I Bonds?

I Bonds are short for Series I Savings Bonds. They are bonds issued by the U.S. government directly to retail investors. Currently, I Bonds carry favorable interest rates over other CDs and bonds. This makes I Bonds the best bonds you can buy at the moment.

How I Bonds Work

Think of I Bonds as flexible-term variable-rate CDs.

You’re required to hold them for at least one year. After that, you can cash out at any time you’d like, or you can choose to hold them for up to 30 years from the original time of purchase. If you cash out within five years, you forfeit interest earned in the previous three months, whereas the early withdrawal penalty on a typical commercial CD is often six months or 12 months of interest. The flexibility to cash out after one year with a low early withdrawal penalty or to hang on for as long as 30 years makes I Bonds good for both short-term and long-term investing.

Similar to a CD, the value of I Bonds never goes down. They are guaranteed by the U.S. government. Unlike a typical CD with a fixed interest rate for the entire term, the interest rate on your I Bonds changes in six-month cycles. You stay on the current rate for the full six months and then you go on a new rate for another six months, and a new rate after that for another six months, and so on.

The interest rate is guaranteed to at least match inflation. If inflation goes up, the interest rate on your I Bonds automatically goes up. Some older I Bonds earn a positive rate above inflation. The I Bonds you buy now only match inflation. Even merely matching inflation makes I Bonds attractive when other CDs and bonds don’t keep up with inflation.

Tax Treatment

The interest on I Bonds is credited monthly and automatically reinvested every six months. You get all the accumulated interest when you cash out. You don’t get a separate payout monthly or quarterly.

You pay tax on the interest from I Bonds only when you decide to cash out, whereas you must pay taxes on the interest from CDs and bond funds every year even if you reinvest the interest. The interest from I Bonds is exempt from state and local income taxes. I Bonds are more appealing than other CDs and bonds because you have the tax deferral and the exemption from state and local income taxes.

Where to Buy I Bonds

There are only two ways to buy I Bonds:

- On a government website TreasuryDirect.gov

- Use money from tax refund when you file your tax return (see details in Overpay Your Taxes to Buy I Bonds)

You can only use regular after-tax money to buy I Bonds. They’re not available in any tax-advantaged accounts such as 401k-type plans, IRAs, or HSAs. Nor are they available through any brokerage firms such as Fidelity, Charles Schwab, or Vanguard.

Purchase Limit

I Bonds are such a great deal that the government puts a limit on how much you can buy each year. At current rates, you should get your full quota before you buy any other CDs or bond funds.

When you buy on the government website TreasuryDirect.gov, the limit is $10,000 each calendar year per Social Security Number as the primary owner in a personal account. When you buy using money from your tax refund, the limit is $5,000 per tax return (not per person when you file jointly).

If you have a trust, you’re allowed to buy another $10,000 each calendar year in a trust account. See Buy More I Bonds in a Revocable Living Trust.

If you have a business, the business can also buy $10,000 each calendar year. See Buy I Bonds for Your Business: Sole Proprietorship, LLC, S-Corp.

If you have kids under 18, you can also buy $10,000 each calendar year in each of your kids’ names. See Buy I Bonds in Your Kid’s Name.

A married couple each with a trust and a self-employment business can buy up to $65,000 each calendar year, and more if they also buy in their kids’ names.

- $10,000 in Person A’s personal account with Person B as the second owner

- $10,000 in Person B’s personal account with Person A as the second owner

- $10,000 in an account for Person A’s trust

- $10,000 in an account for Person B’s trust

- $10,000 in an account for Person A’s business

- $10,000 in an account for Person B’s business

- $5,000 using money from their tax refund

- $10,000 in the name of each of their kids under 18

We had only one trust before. We created a second trust with software to buy another $10,000. For buying I Bonds in a trust account in general, please read Buy More I Bonds in a Revocable Living Trust.

Open Account

If you never bought I Bonds before, you need to open an account at the government website treasurydirect.gov. You can buy more in the same account in subsequent years. Find the Open Account link at the top right.

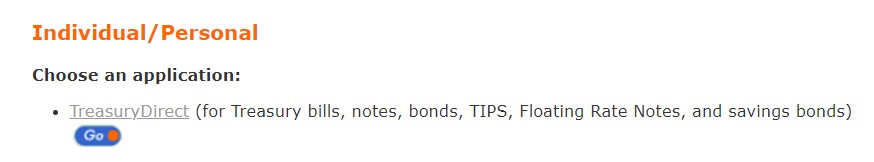

Choose the first option for Individual/Personal. Go here for a trust account or a business account as well.

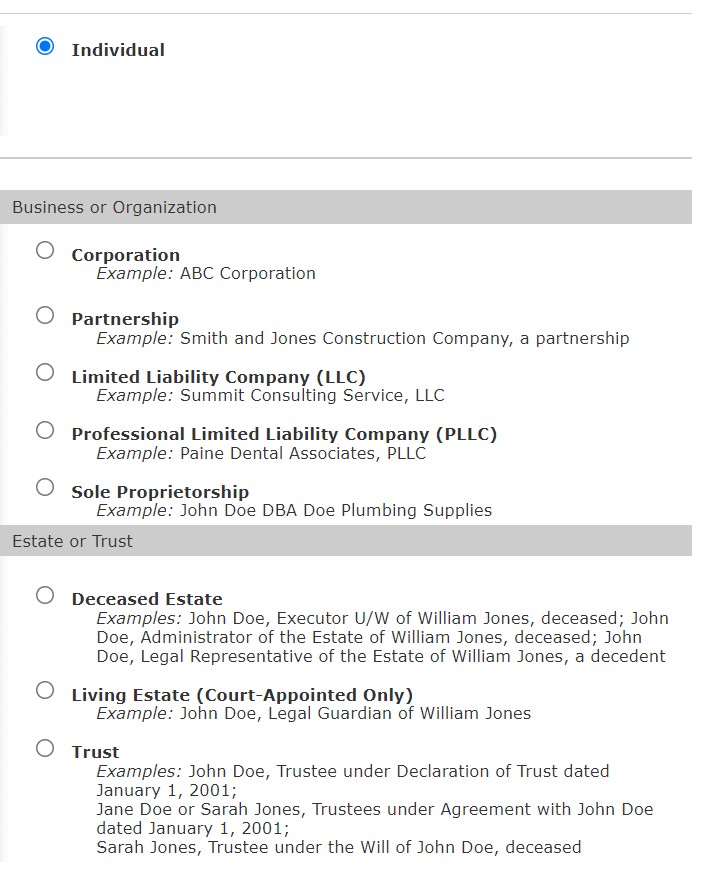

Now you can choose an individual, business, or trust account.

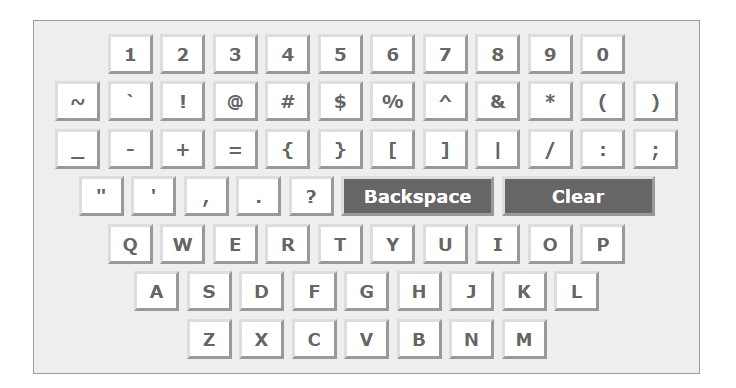

Next, fill out the required information and choose a security image, a password (not case sensitive), and security questions.

TreasuryDirect doesn’t support joint accounts. The individual account you’re opening now is only for yourself. If your spouse also wants to buy I Bonds, he or she must open a separate account. However, you can specify a second owner or beneficiary on the bonds you buy in your personal account. You do that at the holdings level at the time of each purchase.

If you’re opening a trust account, see Buy More I Bonds at TreasuryDirect in a Revocable Living Trust for what to use as the name of your account.

The application also asks you to link a bank account. Important: Please choose a bank account you will keep using forever. Adding the bank account at the time of account application is super easy, but changing the bank account in the future may be quite difficult. Also, make sure you enter the bank routing number and account number correctly. They don’t send any random deposits to verify the bank account. If you enter a wrong number now, it may be difficult to change it in the future.

You will receive your account number by email. Important: save your account number. You’ll need it to log in.

Schedule Purchase

Log in with the account number. The system will email you a one-time password (OTP). Important: Don’t use the back and forward buttons in the browser when you use the TreasuryDirect.gov website. Only use the “submit” and “return” buttons on the web pages.

You enter the password you set when you opened the account on this virtual keyboard. It doesn’t have lower case letters. That’s why the password isn’t case-sensitive.

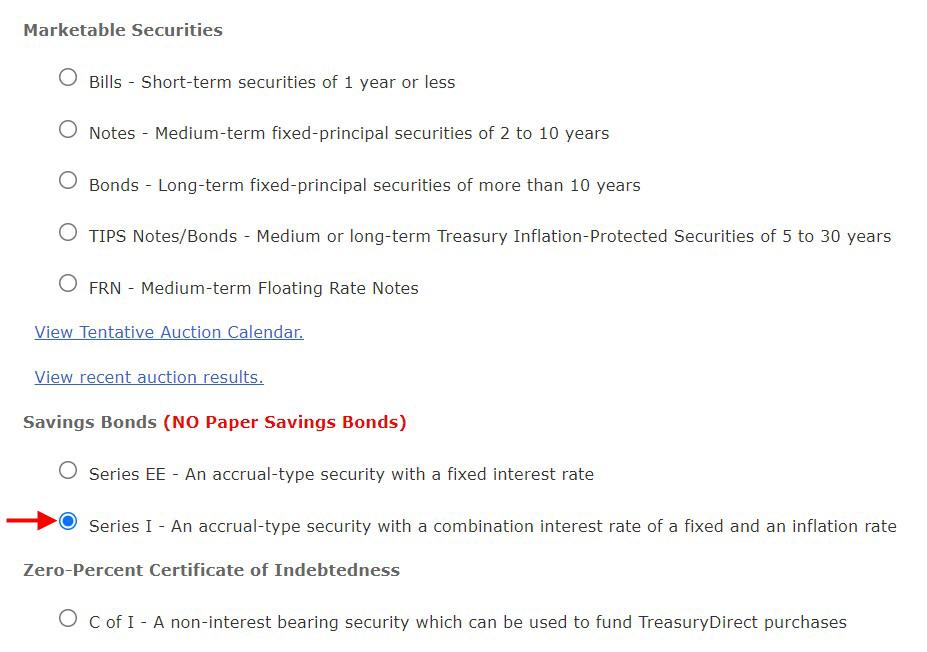

After you log in, go to BuyDirect in the menu.

Although we use TreasuryDirect only to buy I Bonds, the account can be used for other products as well. Choose Series I near the bottom of the list.

Registration

If you’re buying I Bonds for the first time in a personal account, you need to create a Registration, which means whether you want the bonds to have:

- Just yourself as the only owner; or

- You as the primary owner and another person as the second owner; or

- You as the owner and another person as the beneficiary.

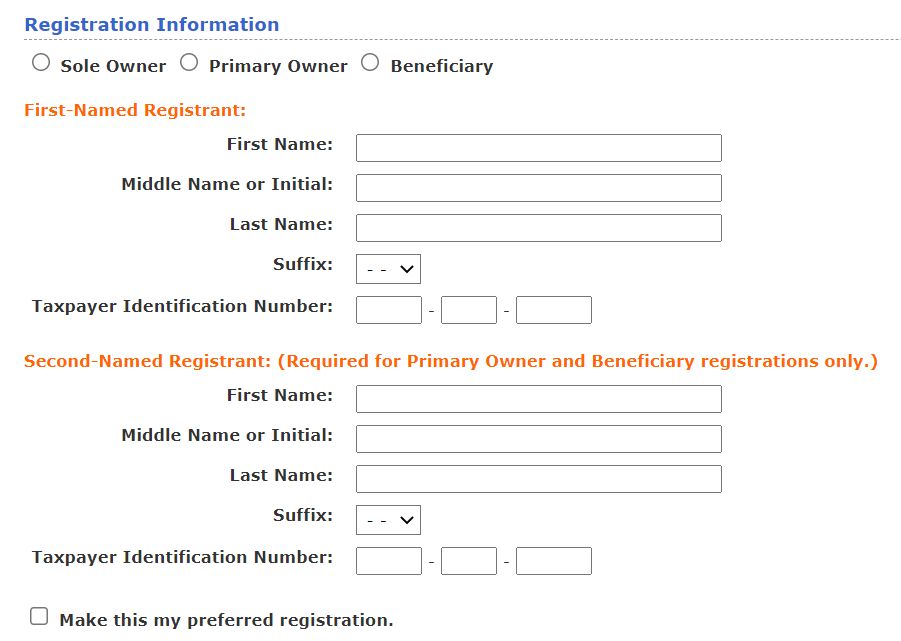

Choose the “Sole Owner” radio button if you want yourself as the only owner with neither a second owner nor a beneficiary. Choose “Primary Owner” if you want yourself as the primary owner with another person as the second owner. Choose “Beneficiary” if you want yourself as the primary owner with another person as the beneficiary. See I Bonds Beneficiary versus Second Owner for the difference between a second owner and a beneficiary.

Unlike in typical commercial accounts, the second owner and the beneficiary in TreasuryDirect are at the holdings level, not at the account level for all holdings. You can have some bonds with Person A as the second owner, some other bonds with Person B as the beneficiary, and so on.

Each bond can have only one second owner or beneficiary but not both. You can’t specify a contingent beneficiary. The second owner or beneficiary has to be a person. It can’t be a trust or a charity. Trust accounts and business accounts can’t buy bonds with a second owner or a beneficiary. The trust or the business will be the only owner.

If you decide to have a second owner or a beneficiary, enter yourself as the “first-named registrant.” Enter the second owner or the beneficiary as the “second-named registrant.”

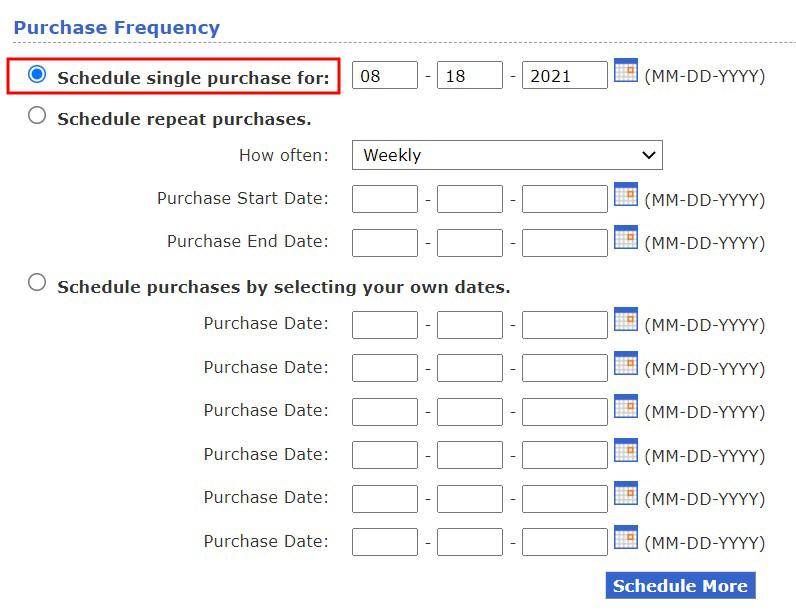

Purchase Date

Choose the purchase date. Make sure you have money available in the linked bank account. They send out the debit the night before your scheduled purchase date. The debit will hit your bank account on the scheduled date first thing in the morning. They may lock your TreasuryDirect account if the debit bounces. It’ll be difficult to unlock it.

Important: Don’t cut it too close to the end of the month, or else you may miss a month worth of interest. It takes one business day to issue the bonds after they receive your money and possibly more days if there’s a delay. If you buy close to the end of the month, your issue date may be in the following month and you won’t get the interest for the previous month. I schedule my purchases to a date at least a week before the end of the month.

Grant Right to the Second Owner or Beneficiary

If you put a second owner or a beneficiary on your I Bonds, the second owner or the beneficiary doesn’t automatically see those bonds in their account. They see the bonds only when you grant them View or Transact right. The beneficiary can only be granted the right to view the bonds (“read-only”). The second owner can be granted either View or Transact right.

See How To Grant Transact or View Right on I Bonds for a walkthrough on how to grant the rights and how a second owner can transact on the bonds on your behalf after you grant the right.

Rinse and Repeat

If you’re buying additional I Bonds in the name of a spouse, a trust, or a business, repeat the steps above by opening a separate account, creating a password, linking a bank account, saving the account number, and scheduling the purchase. The different accounts can use the same email address and link to the same bank account if you’d like. Because you’ll use different account numbers to log in, you should keep notes for which account number is for which owner.

If you’re interested in buying I Bonds in the name of your kid, please read Buy I Bonds in Your Kid’s Name.

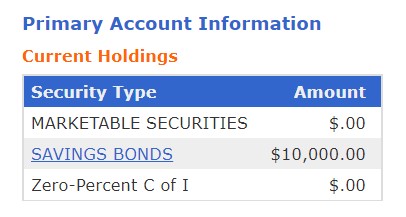

Check Balance

TreasuryDirect doesn’t send any account statements. You check your balance on the website. Your total principal value is displayed on the home page after you log in.

You’ll see a list broken down by the Issue Date when you click on the Savings Bonds link.

If your bonds are still within 5 years from the Issue Date, the Current Value automatically excludes interest earned in the last three months. If you cash out today, you’ll receive the Current Value. That’s why you won’t see any interest in the current value during the first three months.

The interest rate on your bonds doesn’t necessarily change right away when a new rate is announced. Each bond stays on the previous rate for the full six months before it moves on to the next rate. The rates change in different months depending on when your bonds were originally issued. See When does my bond change rates?

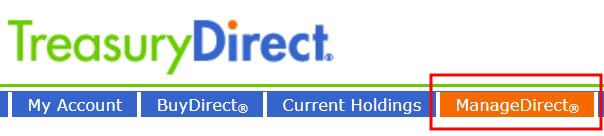

Cash Out (Redeem)

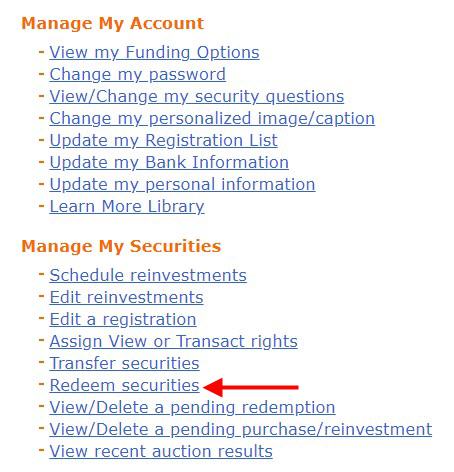

Because I Bonds are better than other bonds and there’s a purchase limit, you should hang on to your I Bonds as much as you can until you have better choices. If you need to cash out some of them (called “redeem” in the government lingo), you use the ManageDirect menu.

The option isn’t really obvious unless you know what to look for.

You don’t have to cash out/redeem the full purchase. Redeeming only part of it is just fine. If you redeem $2,000 from a $10,000 original purchase, the accumulated interest on the $2,000 will be paid out. The money will be sent to your linked bank account on the next business day.

Tax Forms

If you don’t cash out (redeem) any I Bonds in any year, you won’t get a 1099 form for the interest earned. You pay taxes only in the year you cash out.

If you do cash out (redeem) any I Bonds in any year, TreasuryDirect will generate a 1099 tax form for the accumulated interest since your original purchase. They don’t send paper tax forms. You’ll come back to the ManageDirect part of the website at tax time to get the tax form (see the screenshot above).

Customer Service

If still have questions or if you run into any problems, you can contact TreasuryDirect:

- Send an inquiry via their contact form.

- Send an email to Treasury.Direct AT fiscal.treasury.gov.

- Call 844-284-2676 during business hours.

我了解了一下,感觉如果只是为了赚这点利息“借用”小孩SSN的话,还是不要贪图小 孩名下的额度了。对政府来说,给小孩名下买bond就完全成为小孩的钱,也就是说钱基本上锁在小孩名下,直到上大学时。 如果提前支取bond的话,法律上得证明取出来的钱花到小孩身上,报税也会有些tricky。 当然,如果就想着留到大学时,那又得跟529比较了。 总之这个模式适合一部分人群,中农可以,贫农不合适

ReplyDelete对于贫农随时可能用钱的不合适。对于中农,有一部分储蓄应该是放在安全的地方, ibond就是比较安全而且有回报的,比CD强多了。 这个可以滚动买,连续五年存满了,如果基础利率低的时候就取出,高的时候就保留。现在电子的不如纸的方便,不知道能不能指定取出特定年份的,纸的可以,随便拿一张到任何银行都可以随时套现。可惜现在没有纸的了。 对加州码农是看不上这点利息的,对挣二三十万的外地中农,这些利息还是可以的,一年10%就beat十年CD了。

ReplyDelete