https://ttlc.intuit.com/turbotax-support/en-us/help-article/retirement-benefits/enter-backdoor-roth-ira-conversion/L7gGPjKVY_US_en_US

A backdoor Roth IRA allows you to get around income limits by converting a traditional IRA into a Roth IRA. Contributing directly to a Roth IRA is restricted if your income is beyond certain limits, but there are no income limits for conversions.

You’ll receive a Form 1099-R with code 2 in box 7 (or code 7 if your age is over 59 ½) in the year you make your Roth conversion. You should report your conversion for the year you receive this 1099-R:

- If you received this form in 2022, complete both steps below to report it on your 2022 taxes

- If you'll receive this form in 2023, wait to report it on your 2023 taxes. In this case, only complete Step 1 below for your 2022 taxes. You’ll complete both steps next year when filing your taxes for 2023

Doing a backdoor Roth conversion is a two-step process.

TurboTax CD/Download

Step 1: Enter the Non-Deductible Contribution to a Traditional IRA

- Sign in to your TurboTax account

- Open or continue to your return if it’s not already open

- Select the Federal Taxes tab (this is Personal Info in TurboTax Home & Business), then Deductions & Credits

- Select I'll choose what I work on

- On the list of sections, locate Retirement & Investments

- Then select Start or Update next to Traditional & Roth IRA Contributions

- Check the box for Traditional IRA and Continue

- Answer Yes to Did you contribute to a traditional IRA?

- Answer No to Is This a Repayment of a Retirement Distribution?

- On the Tell Us How Much You Contributed screen, enter the amount contributed and Continue

- Answer No on the screen Did You Change Your Mind?, then answer the questions on the following screens

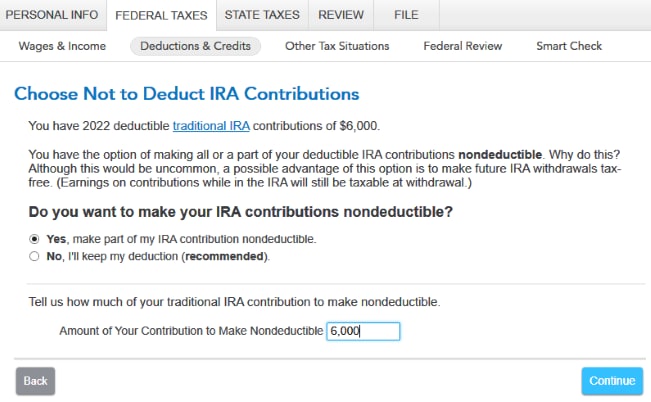

- When you reach the Choose Not to Deduct IRA Contributions screen, select Yes, make part of my IRA contribution nondeductible, enter the amount you contributed, then select Continue.

If none of your contribution can be deducted, you will not see the

option to make part of it nondeductible. Instead, the full amount of

your contribution will automatically be nondeductible

Step 2: Enter the Conversion from a Traditional IRA to a Roth IRA

- Select Wages & Income, then I'll choose what I work on

- In the list of sections, locate Retirement Plans and Social Security, then select Start or Update next to IRA, 401(k), Pension Plan Withdrawals (1099-R)

- Answer Yes to Did you have any of these types of income in 2022? and Continue

- If you land on the Your 1099-R Entries screen instead, select Add Another 1099-R

- Select how you want to enter your 1099-R (import or type it in yourself) and follow the instructions

- Answer No to Did You Inherit This IRA?

- Answer None of this distribution was transferred to charity

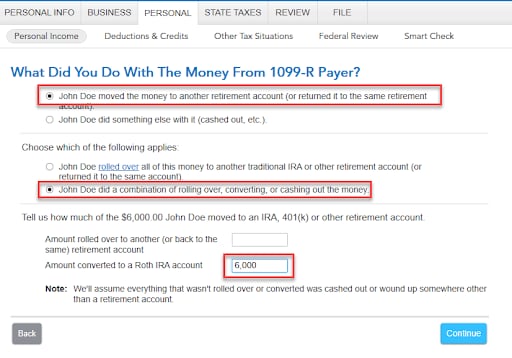

- Select I moved the money to another retirement account (or returned it to the same retirement account) on the What Did You Do With The Money From This Payer? screen

- Select I did a combination of rolling over, converting, or cashing out the money. Then, enter the full amount in the box next to Amount converted to a Roth IRA account and Continue

- Continue answering questions until you come to the screen Your 1099-R Entries

To check the results of your backdoor Roth IRA conversion, see your Form 1040:

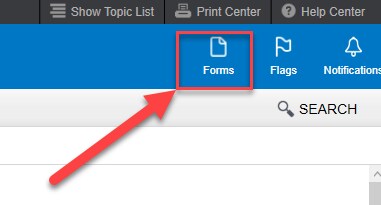

- Select Forms from the menu

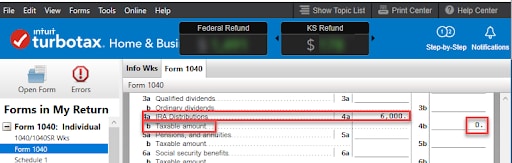

- Select Form 1040 from the menu

- Use the scroll bar to find:

- Line 4a IRA Distributions. Your backdoor Roth IRA amount should be listed

- Line 4b Taxable amount

should be zero, unless you had earnings between the time you

contributed to your Traditional IRA and the time you converted it to a

Roth IRA

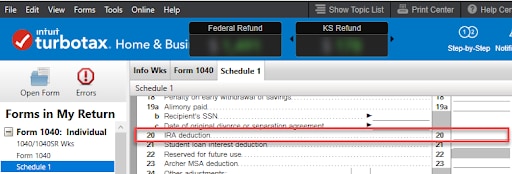

- Select Schedule 1 from the menu

- Line 20 IRA deduction should be blank

- To return to where you left off in TurboTax, select Step-by-Step from the menu at the top of the screen

Comments

Post a Comment

https://gengwg.blogspot.com/