https://thefinancebuff.com/how-to-report-backdoor-roth-in-turbotax.html

What To Report

You report on the tax return your contribution to a Traditional IRA *for* that year and your conversion to Roth *during* that year.

For example, when you are doing your tax return for year X, you report the contribution you made *for* year X, whether you actually did it during year X or between January 1 and April 15 of the following year. You also report your conversion to Roth *during* year X, whether the contribution was made for year X, the year before, or any previous years.

Therefore a contribution made during the following year for year X goes on the tax return for year X. A conversion done during year Y after you made a contribution for year X goes on the tax return for year Y.

You do yourself a big favor and avoid a lot of confusion by doing your contribution for the current year and finish your conversion in the same year. I called this a “planned” Backdoor Roth — you’re doing it deliberately. Don’t wait until the following year to contribute for the previous year. Contribute for year X in year X and convert it during year X. Contribute for year Y in year Y and convert it during year Y. This way everything is clean and neat.

If you are already off by one year, catch up. Contribute for both the previous year and the current year, then convert the sum during the same year. See Make Backdoor Roth Easy On Your Tax Return.

Use TurboTax Download

The screenshots below are from TurboTax Deluxe downloaded software. The downloaded software is way better than online software. If you haven’t paid for your TurboTax Online filing yet, you can buy TurboTax download from Amazon, Costco, Walmart, and many other places and switch from TurboTax Online to TurboTax download.

Here’s the planned Backdoor Roth scenario we will use as an example:

You contributed $6,000 to a traditional IRA in 2021 for 2021. Your income is too high to claim a deduction for the contribution. By the time you converted it to Roth IRA, also in 2021, the value grew to $6,200. You have no other traditional, SEP, or SIMPLE IRA after you converted your traditional IRA to Roth. You did not roll over any pre-tax money from a retirement plan to a traditional IRA after you completed the conversion.

If your scenario is different, you will have to make some adjustments to the screens shown here.

Before we start, suppose this is what TurboTax shows:

We will compare the results after we enter the Backdoor Roth.

Convert Traditional IRA to Roth

The tax software works on income items first. Even though the conversion happened after the contribution, we enter the conversion first.

When you convert from Traditional IRA to Roth, you will receive a 1099-R form. Complete this section only if you converted *during* the year for which you are doing the tax return. If you only converted during the following year, you won’t have a 1099-R until next January. Skip this section and wait until the next year.

In our example, we assume by the time you converted, the money in the Traditional IRA had grown from $6,000 to $6,200.

Enter 1099-R

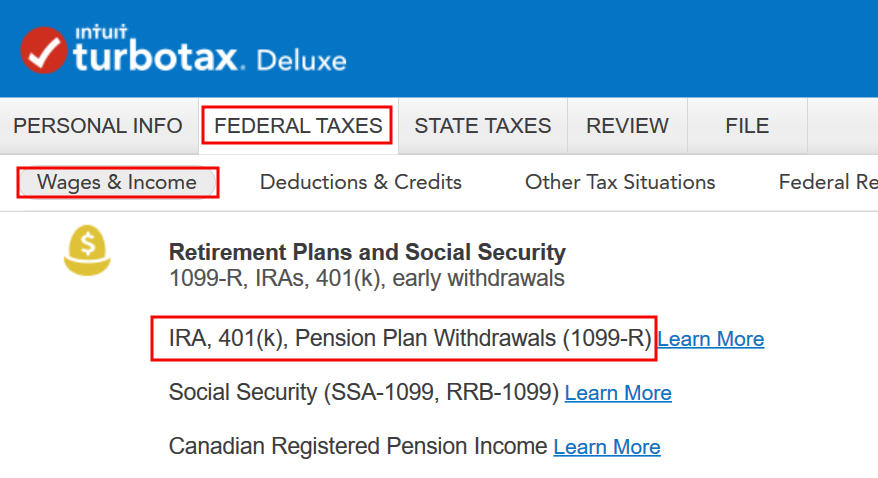

Go to Federal Taxes -> Wages & Income -> IRA, 401(k), Pension Plan Withdrawals (1099-R).

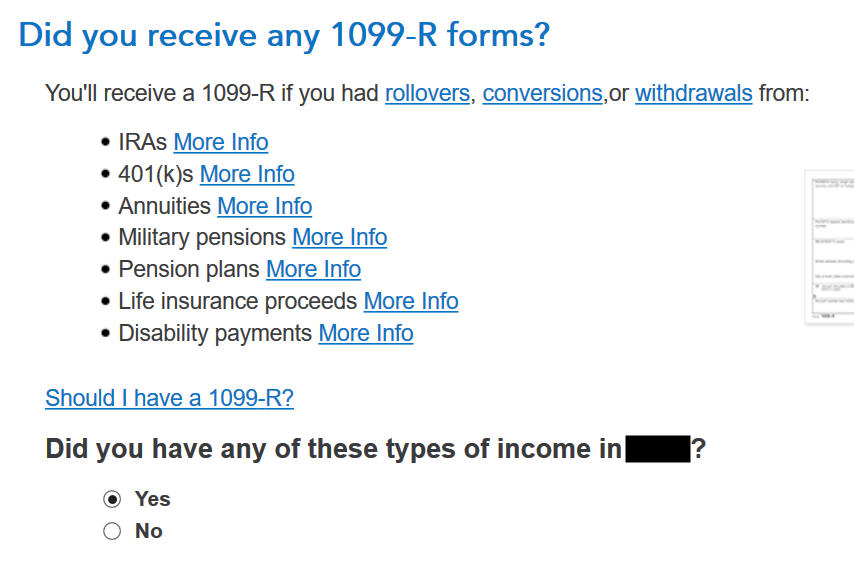

As you work through the interview, you will eventually come to the point to enter the 1099-R. Select Yes, you have this type of income. Import the 1099-R if you’d like. I’m choosing to type it myself.

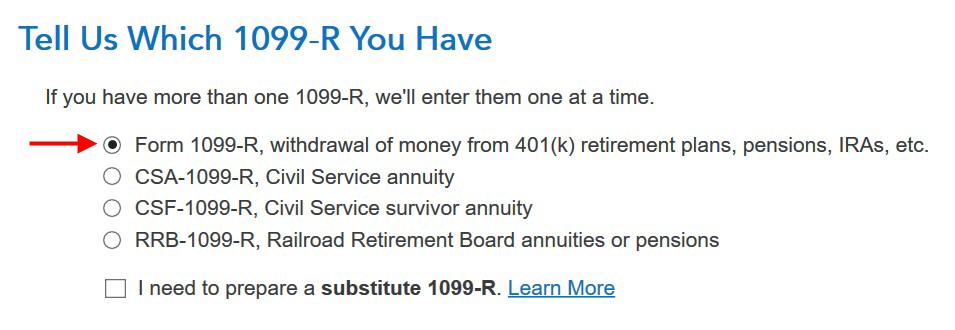

Just the regular 1099-R.

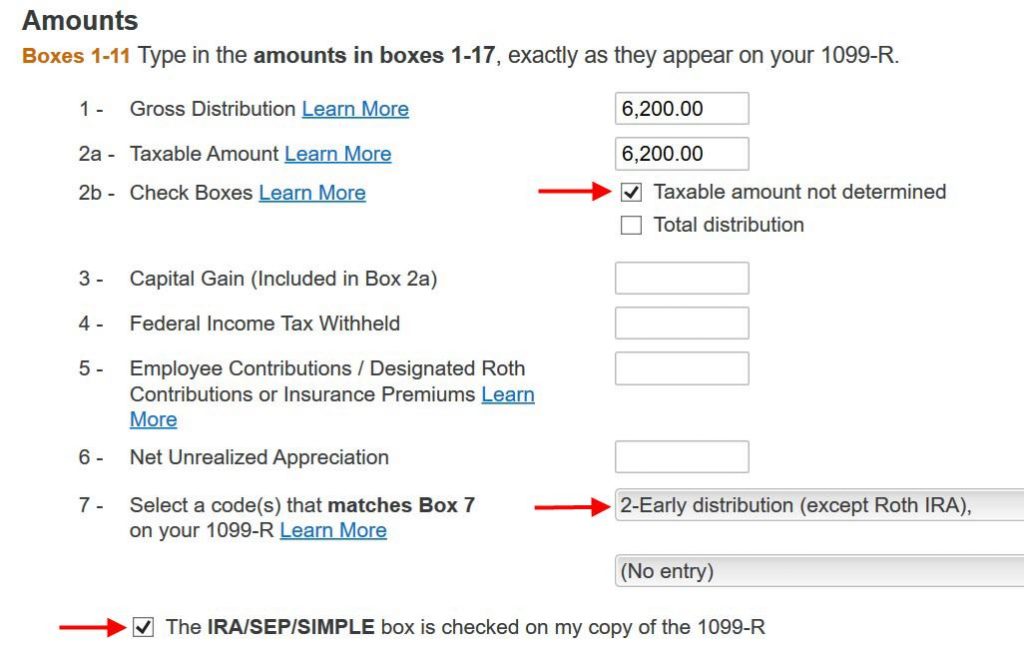

Box 1 shows the amount converted to Roth IRA. It’s normal to have the same amount as the taxable amount in Box 2a when Box 2b is checked saying “taxable amount not determined.” Pay attention to the code in Box 7 and the IRA/SEP/SIMPLE box. Make sure your entry matches your 1099-R exactly.

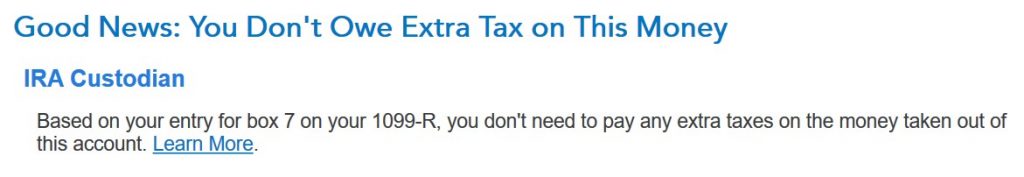

You get this Good News, but …

Your refund in progress drops a lot. We went from $2,384 down to $858. Don’t panic. It’s normal and temporary.

Converted to Roth

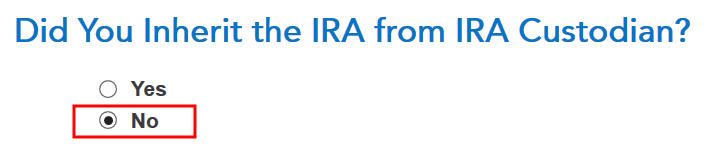

Didn’t inherit it.

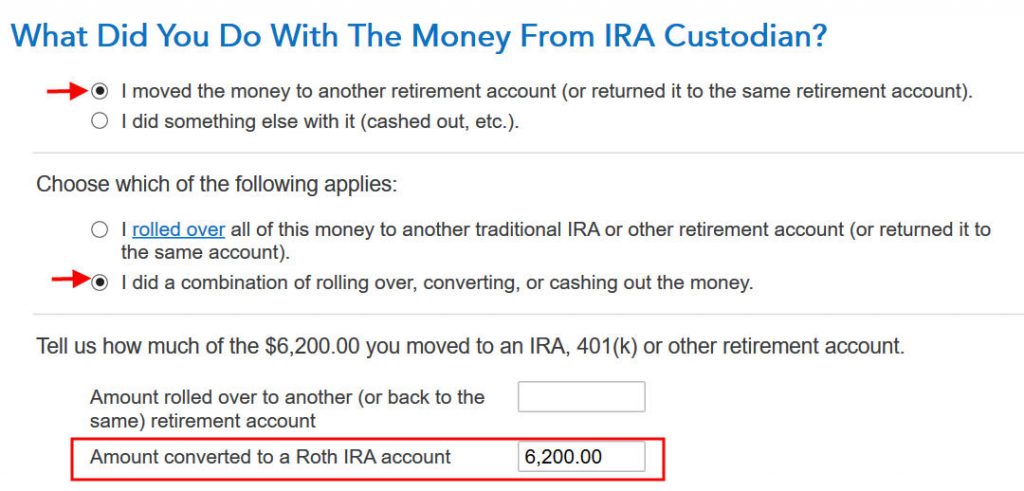

First click on “I moved …” then click on “I did a combination …” Enter the amount converted in the box. Don’t choose the “I rolled over …” option. A Roth conversion is not a rollover.

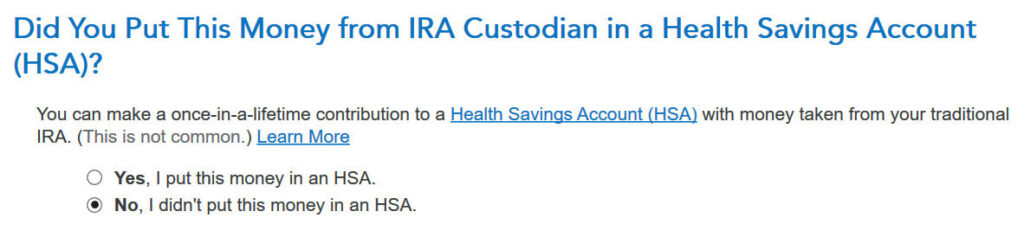

No, you didn’t put the money in an HSA.

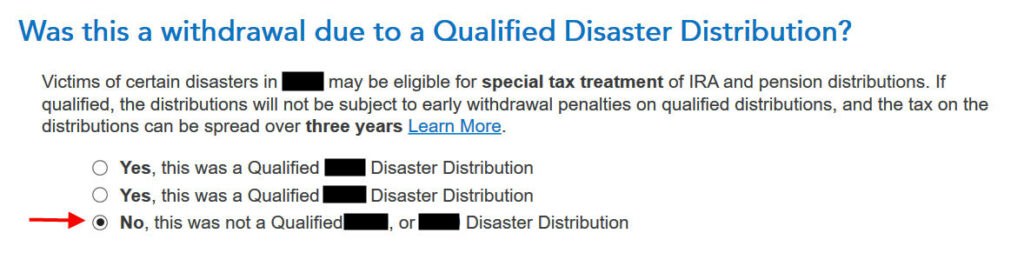

Not due to a disaster.

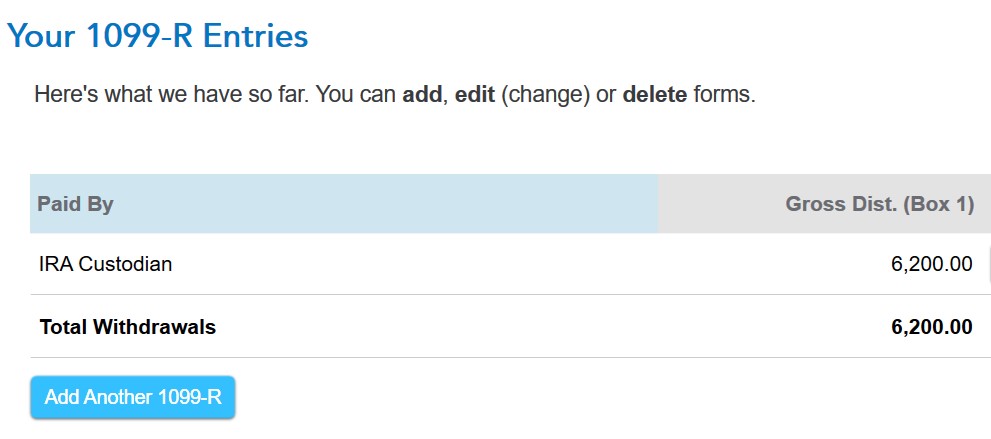

You get a summary of your 1099-R’s. Repeat the previous steps to add another if you have more than one. If you’re married and both of you did a Backdoor Roth, enter the 1099-R for both of you, but pay attention to select whose 1099-R it is. Don’t accidentally assign two 1099-R’s to the same person.

Basis and End-of-Year Values

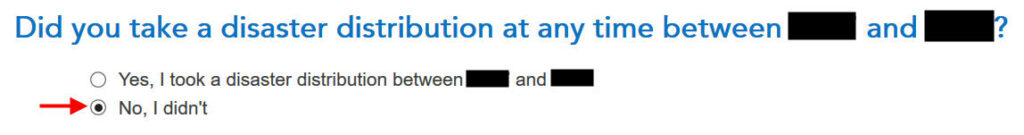

Didn’t take any disaster distribution.

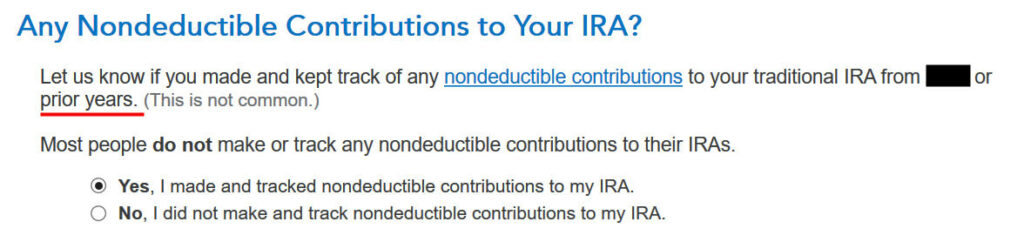

Here it’s asking about the prior year carryover. When you’re doing a clean “planned” Backdoor Roth as in our example — contribute for year X in year X and convert before the end of year X — you can answer No here. If you contributed for the previous year between January 1 and April 15 during year X, answer Yes here.

If you answered Yes to the previous question and you did your previous year’s return correctly also in TurboTax, your basis from the previous year will show up here. If you did your previous year’s tax return wrong, fix your previous return first.

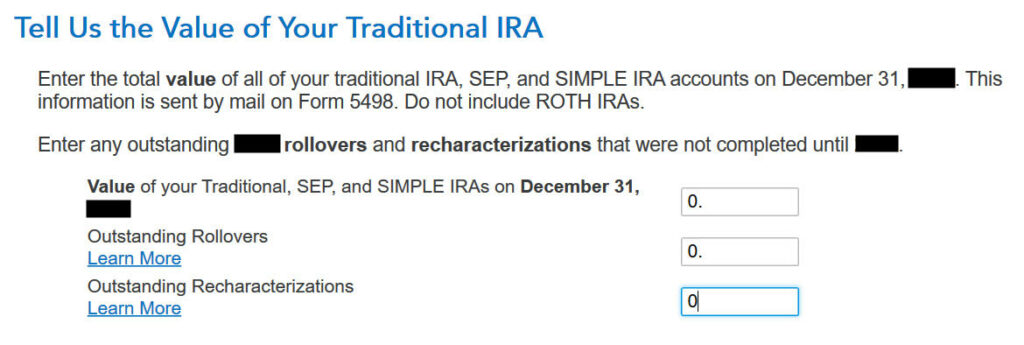

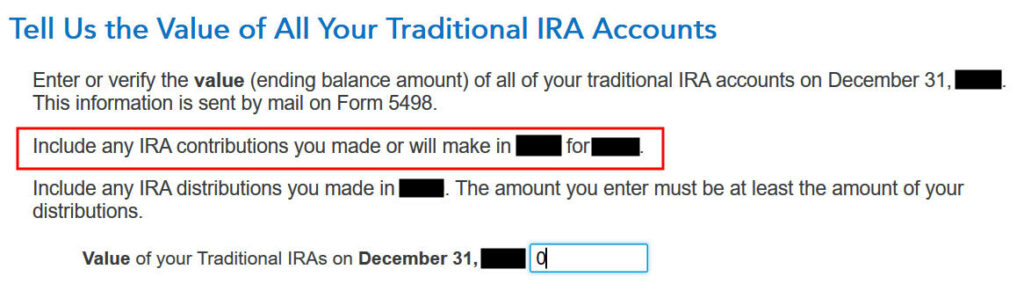

Enter the values at the end of the year. We don’t have anything in traditional, SEP, or SIMPLE IRAs after we converted it all.

That’s it so far on the income side. Continue with other income items. The refund in progress is still temporarily depressed. Don’t worry. It will change.

Non-Deductible Contribution to Traditional IRA

Now we enter the non-deductible contribution to a Traditional IRA *for* the year we are doing the tax return.

Complete this part whether you contributed before December 31 or you did it or are planning to do it in the following year between January 1 and April 15. If your contribution during the year in question was for the year before, make sure you entered it on the previous tax return. If not, fix your previous return first.

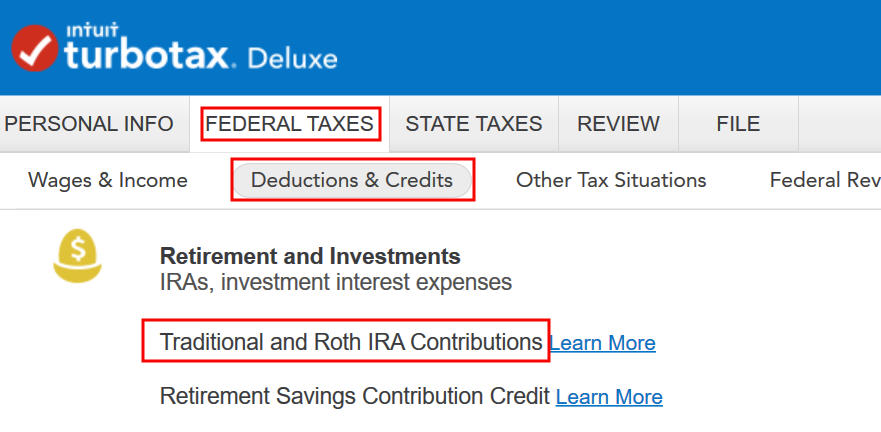

Go to Federal Taxes -> Deductions & Credits -> Traditional and Roth IRA Contributions.

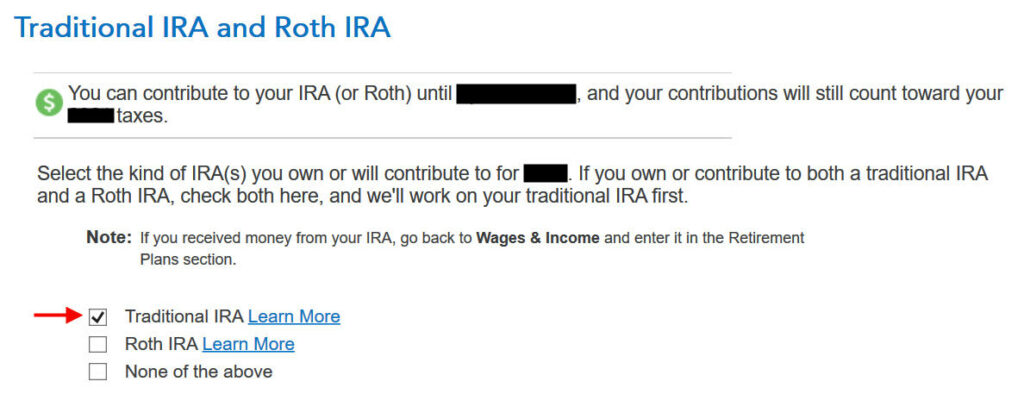

Because we did a clean “planned” Backdoor Roth, we check the box for Traditional IRA. If you did a detour when you first contributed to a Roth IRA before you realized your income is too high and you recharacterized the contribution as to a Traditional IRA, check the box for Roth IRA and answer the questions accordingly.

TurboTax offers an upgrade but we choose to stay in TurboTax Deluxe.

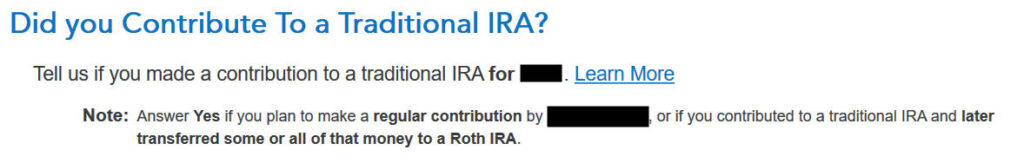

We already checked the box for Traditional but TurboTax just wants to make sure.

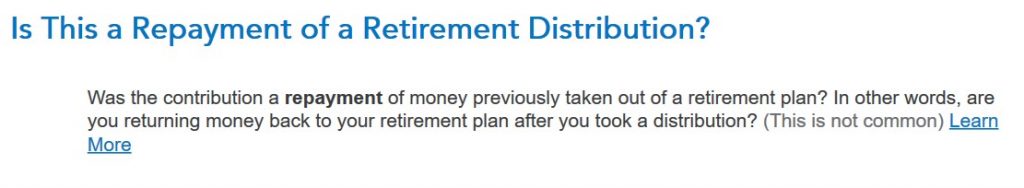

It was NOT a repayment of a retirement distribution.

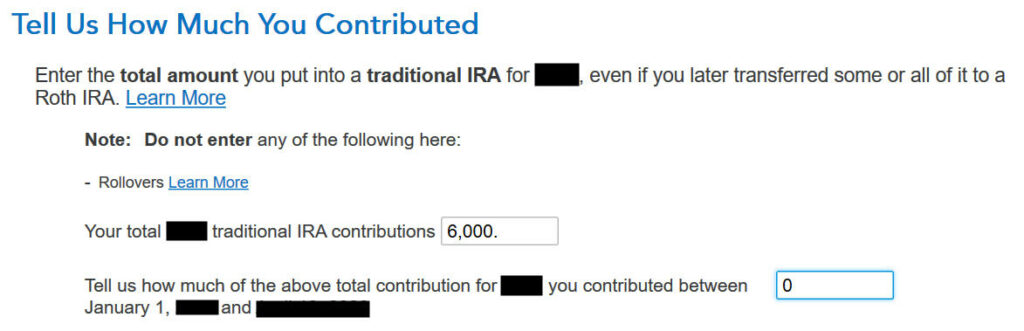

Enter the contribution amount. Because we contributed for year X in year X, we put zero in the second box. If you contributed for the previous year between January 1 and April, enter the contribution in both boxes.

Right away our federal refund in progress goes back up! We started with $2,384. It went down to $858. Now it comes back to $2,335. The $49 difference is because we have to pay tax on the $200 in earnings when we contributed $6,000 and converted $6,200. If you had less in earnings, your refund numbers would be closer still.

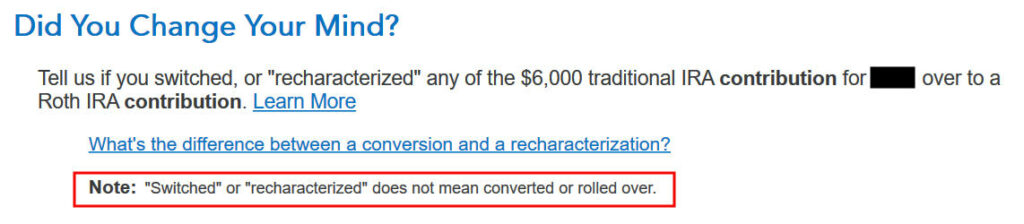

This is a critical question. Answer “No.” You converted the money, not switched or recharacterized.

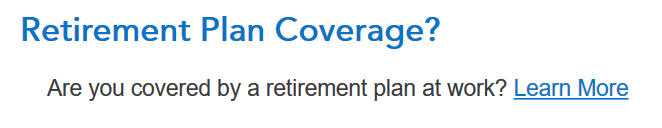

You may not get this question if you already entered your W-2 and it has Box 13 for the retirement coverage checked. Answer yes if you’re covered by a retirement plan but the box on your W-2 wasn’t checked.

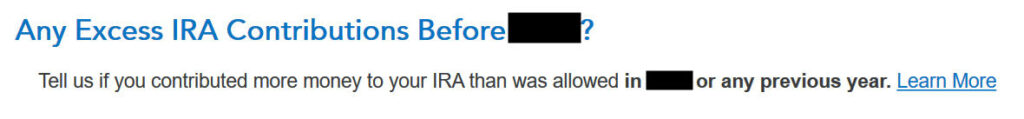

No excess contribution.

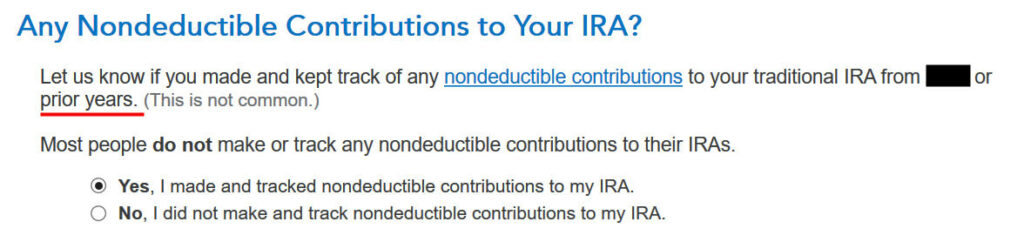

Same question we saw before. For a clean “planned” Backdoor Roth, we can answer No. If you made non-deductible contribution for previous years, answer Yes.

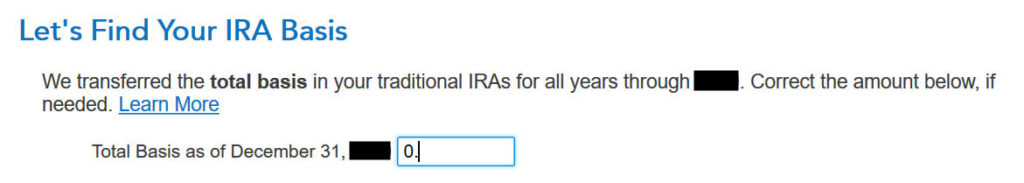

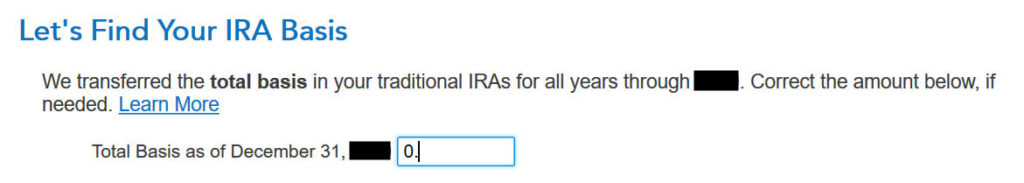

Total basis through the previous year. If you did your taxes correctly on TurboTax last year, TurboTax transfers the number here. If you made non-deductible contributions for previous years (regardless of when), enter the number on line 14 of your Form 8606 from last year.

Because we did a clean “planned” Backdoor Roth, we don’t have anything left after we converted everything before the end of the same year.

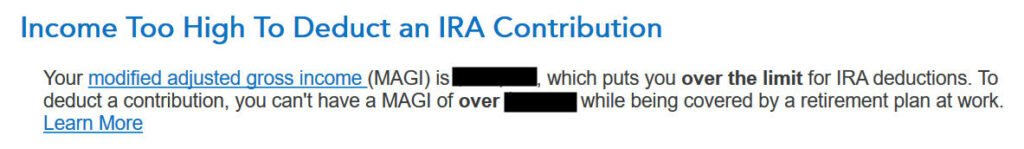

Income too high, we know. That’s why we did the Backdoor Roth.

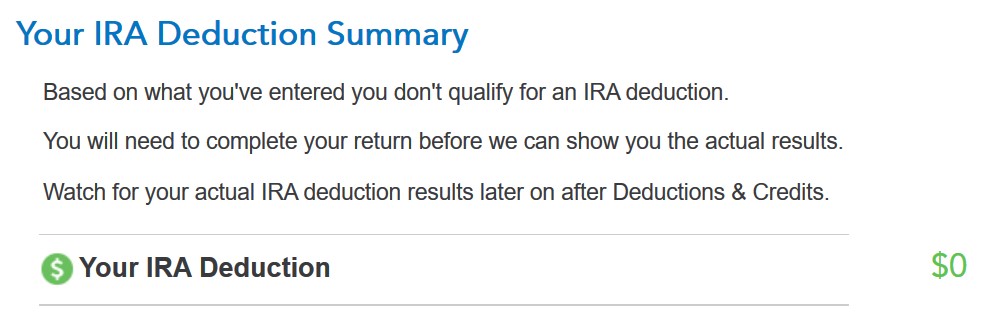

The IRA deduction summary shows $0 deduction, which is expected.

Taxable Income from Backdoor Roth

After going through all these, would you like to see how you are taxed on the Backdoor Roth?

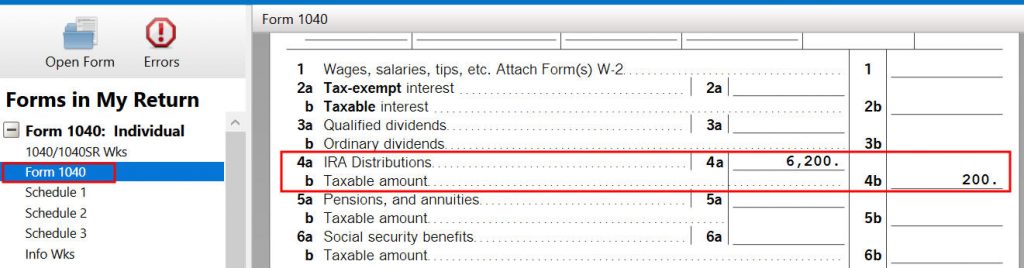

Click on Forms on the top right.

Find Form 1040 in the left navigation panel. Scroll up or down on the right to find lines 4a and 4b. They show a $6,200 distribution from the IRA and only $200 of the $6,200 is taxable. That’s the earning between the time you contributed to your Traditional IRA and the time you converted it to Roth.

When you’re done examining the form, click on Step-by-Step on the top right to go back to the interview.

Tah-Dah! You got money into a Roth IRA through the backdoor when you aren’t eligible for contributing to it directly. That’s why it’s called a Backdoor Roth. You will pay tax on a small amount in earnings if you waited between contributions and conversion. That’s negligible relative to the benefit of having tax-free growth on your contributions for many years.

Troubleshooting

If you followed the steps and you are not getting the expected results, here are a few things to check.

Fresh Start

It’s best to follow the steps fresh in one pass. If you already went back and forth with different answers before you found this guide, some of your previous answers may be stuck somewhere you no longer see. You can delete them and start over.

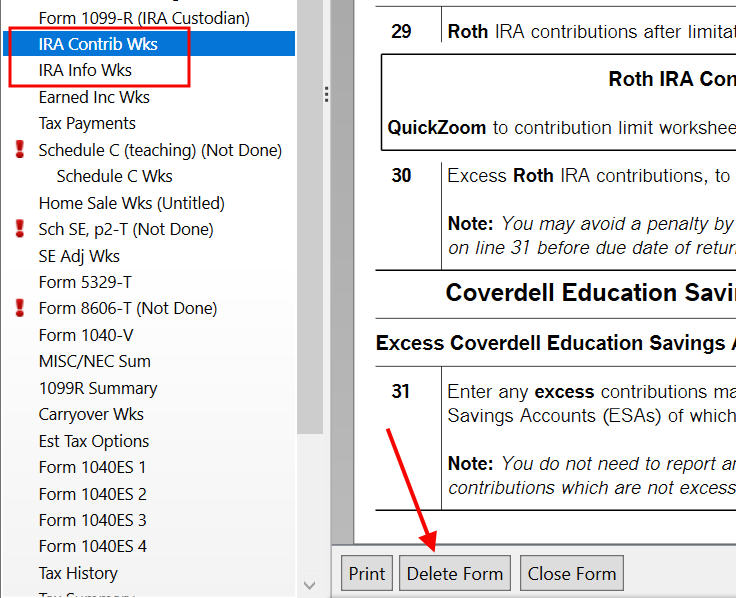

Click on Forms on the top right.

Find “IRA Contrib Wks” and “IRA Info Wks” in the left navigation pane and click on “Delete Form” to delete them. Then you can start over following the steps above.

W-2 Box 13

Make sure the Retirement Plan box in Box 13 of the W-2 you entered into the software matches your actual W-2. If you are married and both of you have a W-2, make sure your entries for both W-2’s match the actual forms you received.

When you are not covered by a retirement plan at work, such as a 401k or 403b plan, your Traditional IRA contribution may be deductible, which also makes your Roth conversion taxable.

Self vs Spouse

If you are married, make sure you don’t have the 1099-R and IRA contribution mixed up between yourself and your spouse. If you inadvertently entered two 1099-Rs issued to you instead of one for you and one for your spouse, the second 1099-R to you will not match up with a Traditional IRA contribution made by your spouse. If you entered a 1099-R for both yourself and your spouse but you only entered one Traditional IRA contribution, you will be taxed on one 1099-R.

https://thefinancebuff.com/mega-backdoor-roth-in-turbotax.html

ReplyDelete