https://thefinancebuff.com/mega-backdoor-roth-in-turbotax.html

A Mega Backdoor Roth means making non-Roth after-tax contributions to a 401k-type plan and then moving it to the Roth account within the plan or taking the money out (with earnings) to a Roth IRA. It’s a great way to put additional money into a Roth account without having to pay much additional tax. Not all plans allow non-Roth after-tax contributions but some estimated that 40% of people can do it.

Suppose your plan allows it and you executed a Mega Backdoor Roth. You will receive a 1099-R from the plan in the following year. You will need to account for it on your tax return.

It’s quite straightforward. Here’s how to do it in TurboTax Deluxe downloaded software. The downloaded software is way better than online software. If you haven’t paid for your TurboTax Online filing yet, you can buy TurboTax from Amazon or Costco and switch from TurboTax Online to TurboTax download.

If you use other tax software, please see:

- How To Enter Mega Backdoor Roth In H&R Block Tax Software or

- How To Enter Mega Backdoor Roth in FreeTaxUSA.

In-Plan Rollover

You can do the Mega Backdoor Roth in two ways — convert within the plan or withdraw to a Roth IRA. Converting within the plan is much easier, and many plans automate this process. Withdrawing to a Roth IRA also works. See the previous post Mega Backdoor Roth: Convert Within Plan or Out to Roth IRA?

Let’s first look at converting to the Roth account within the plan. Here’s the scenario we’ll use as an example:

You contributed $10,000 as non-Roth after-tax contributions to your 401(k). By the time the money was converted to the Roth account within the plan, your contributions earned $200. You converted $10,200 to your Roth 401(k) account.

I’m using 401(k) as a shorthand. It works the same in a 403(b). Now the entries into TurboTax.

1099-R Entries

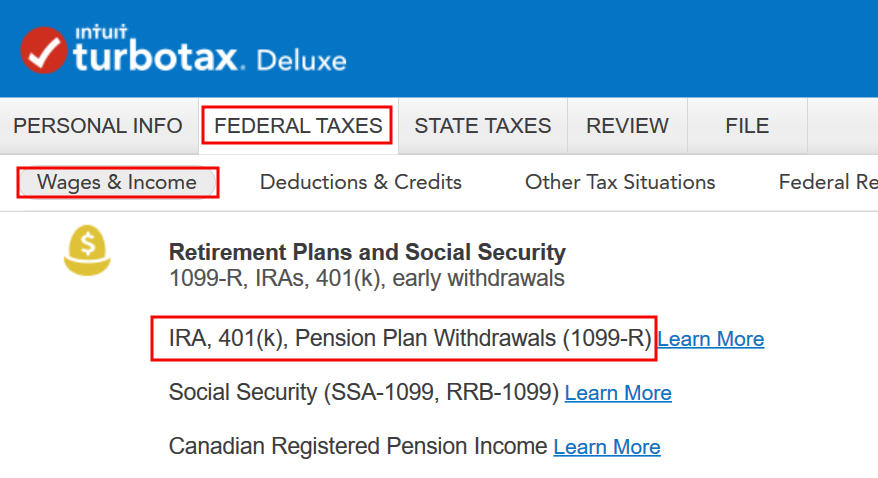

Go to Federal Taxes -> Wages & Income -> IRA, 401(k), Pension Plan Withdrawals (1099-R).

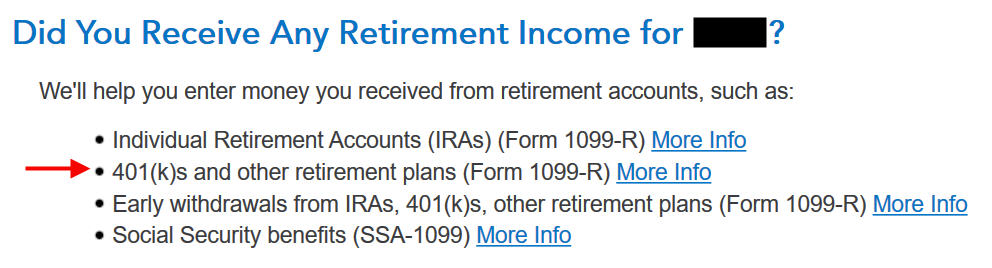

When you come to the Retirement Income section, answer Yes because you received a 1099-R from your 401(k) plan.

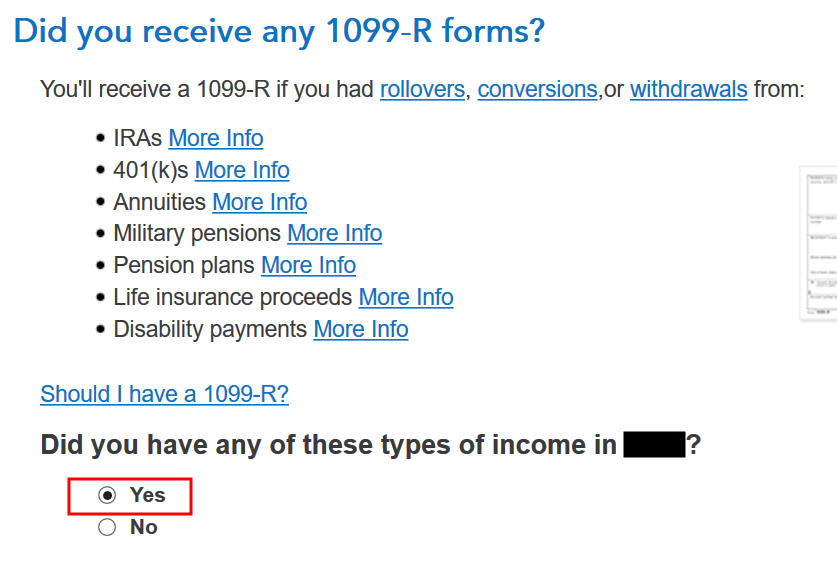

Yes, you received a 1099-R form. Import the 1099-R if you’d like. I’m typing it myself here.

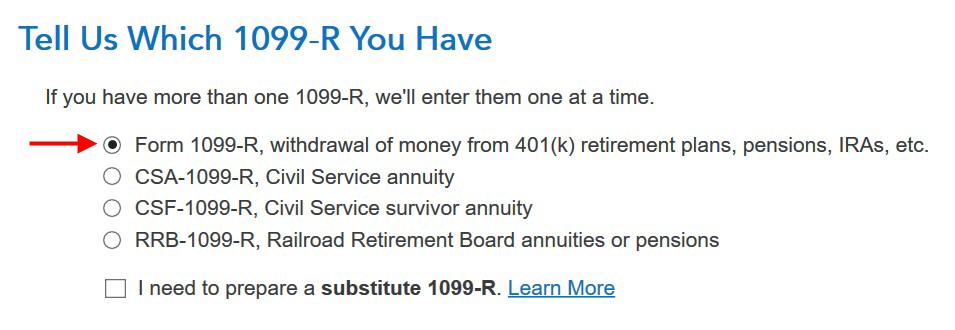

You have a normal 1099-R.

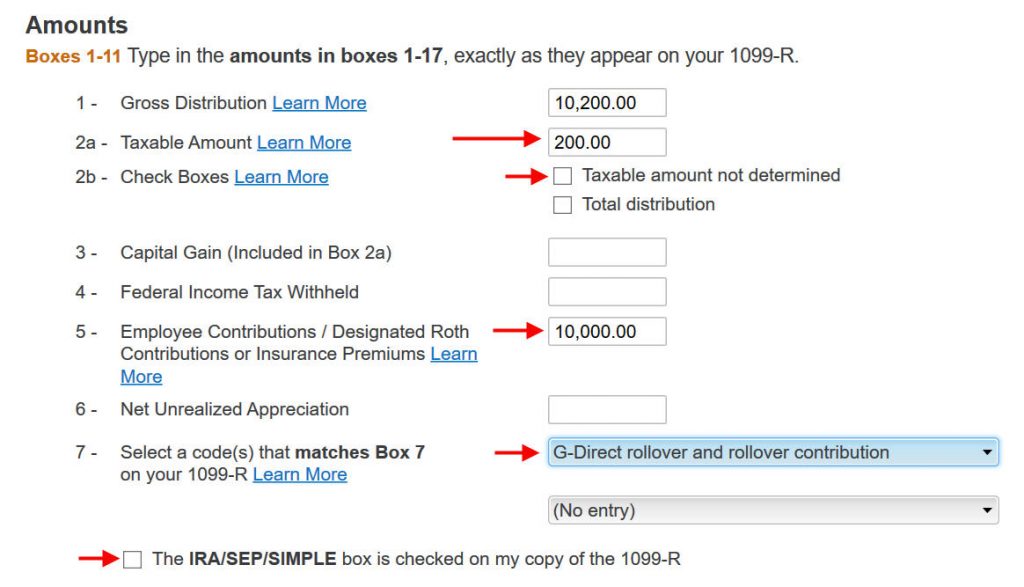

If you import the 1099-R, check the import carefully to make sure it matches your copy exactly. If you type the 1099-R, be sure to type it exactly. The earnings portion should be in box 2a. Box 2b “Taxable amount not determined” should NOT be checked. The after-tax non-Roth contributions (the “principal”) should be in box 5. Box 7 should show a code G. Finally, the box “The IRA/SEP/SIMPLE box is checked on my copy of the 1099-R” should NOT be checked.

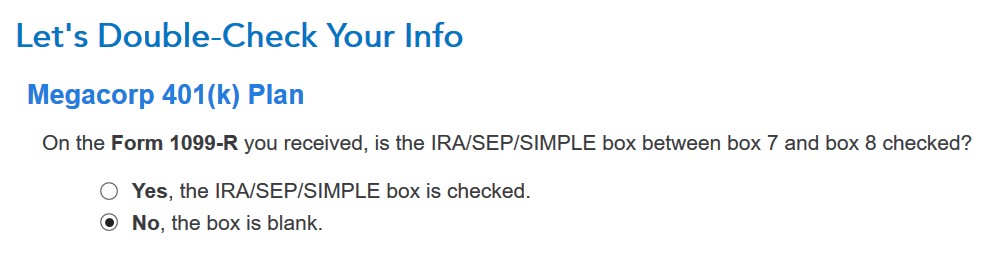

TurboTax wants to make sure the IRA/SEP/SIMPLE checkbox is not checked.

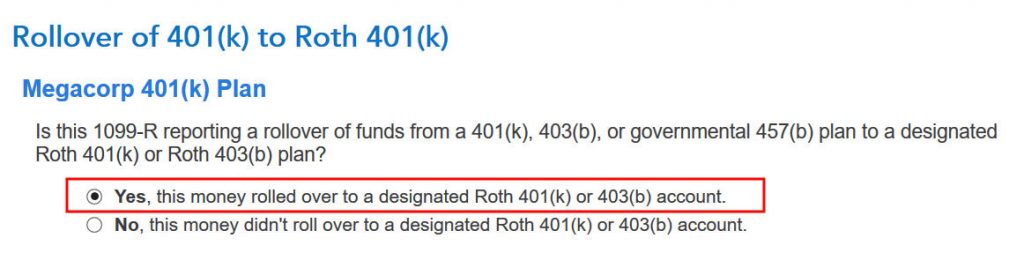

Choose Yes when you converted the money within the plan.

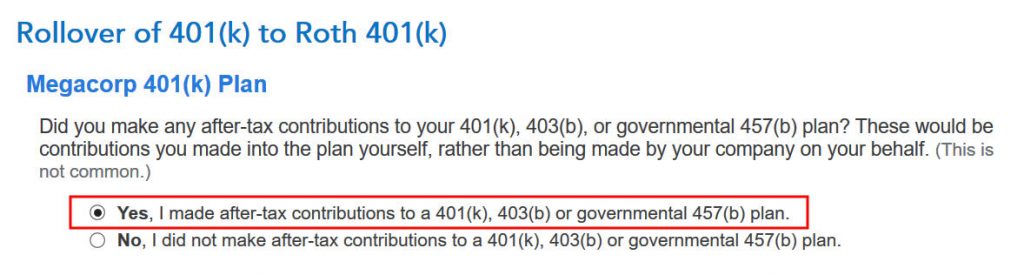

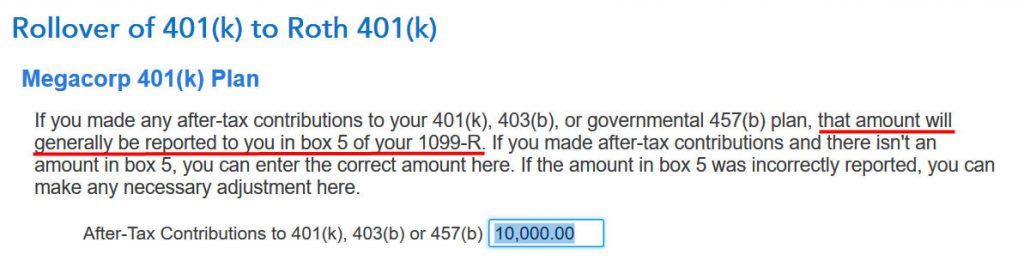

Confirm that you made after-tax non-Roth contributions to your plan.

TurboTax pulls up the amount of your after-tax non-Roth contributions from box 5 of your 1099-R. If your 1099-R isn’t correct, you should work with your 401(k) administrator to have it corrected.

Not a public safety officer, unless you actually are one.

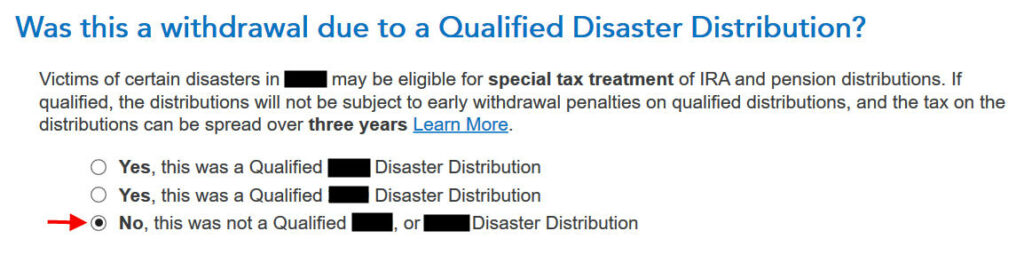

Not due to a disaster.

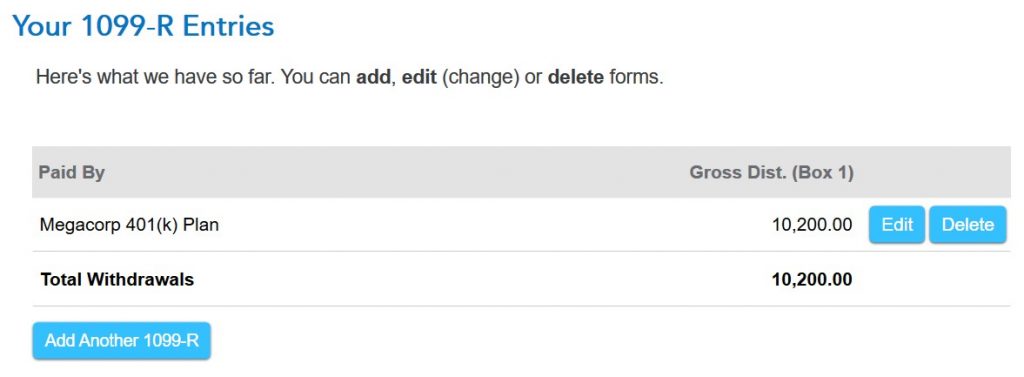

The summary shows your 1099-R entries.

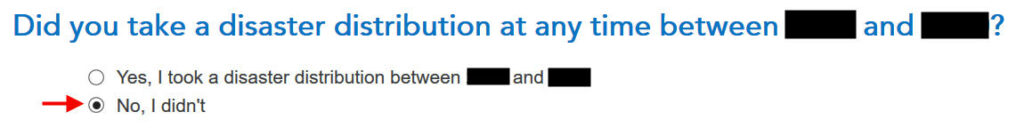

Not affected by a disaster.

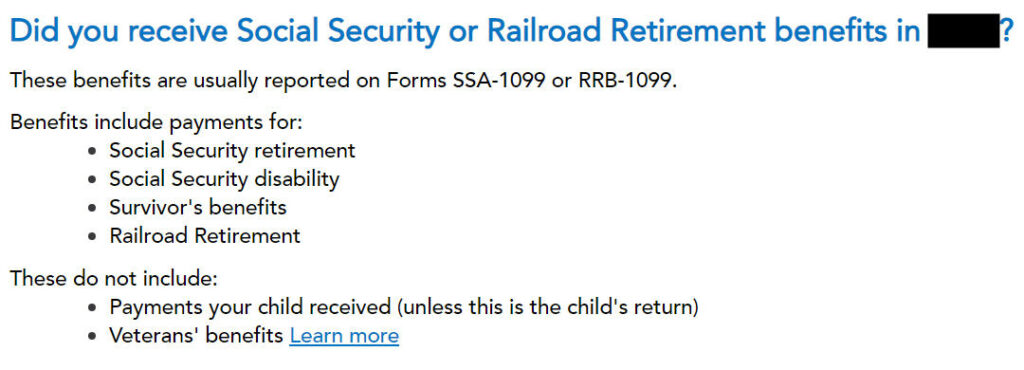

When you see TurboTax moving on to a totally separate topic, in our case Social Security Benefits, you know that’s the end of reporting your Mega Backdoor Roth.

Verify on Form 1040

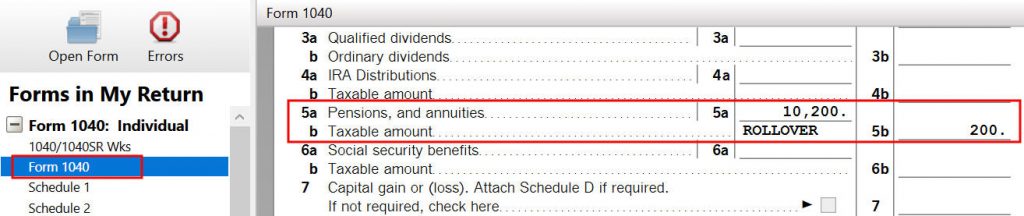

Now let’s confirm you’re only paying tax on the $200 earnings, not on your $10,000 after-tax non-Roth contributions.

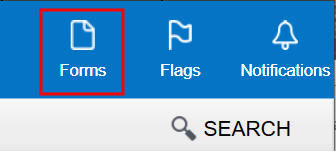

Click on Forms on the top right.

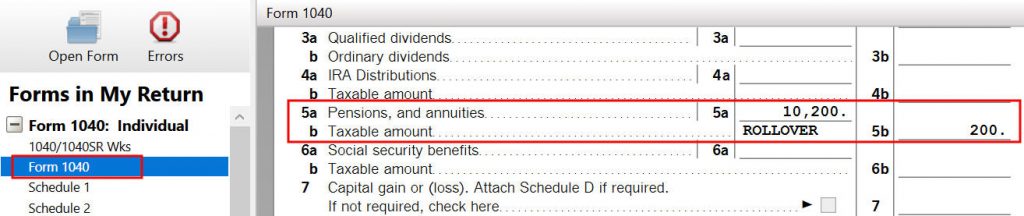

Find “Form 1040” in the left navigation pane. Scroll up or down in the right pane to lines 5a and 5b. Line 5a includes the $10,200 gross distribution amount. Line 5b only includes the $200 taxable amount. With a Mega Backdoor Roth, you got an extra $10k into your Roth account. After paying tax on this $200, the future earnings on the $10,200 will be tax-free.

When you’re done examining the form, click on Step-by-Step on the top right to get back to the interview.

Withdraw to Roth IRA

Now let’s look at the Mega Backdoor Roth variation when you withdraw the after-tax non-Roth contributions plus earnings to a Roth IRA. Here’s the scenario we’ll use as an example:

You contributed $10,000 as non-Roth after-tax contributions to your 401(k). By the time you rolled over the money to a Roth IRA, your contributions earned $200. You rolled over $10,200 to your Roth IRA.

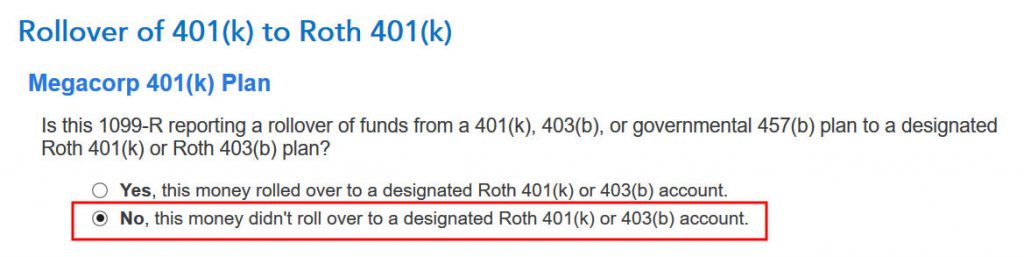

The steps in TurboTax are the same as converting to the Roth account within the plan until this question:

When you took the money to a Roth IRA, you answer No here.

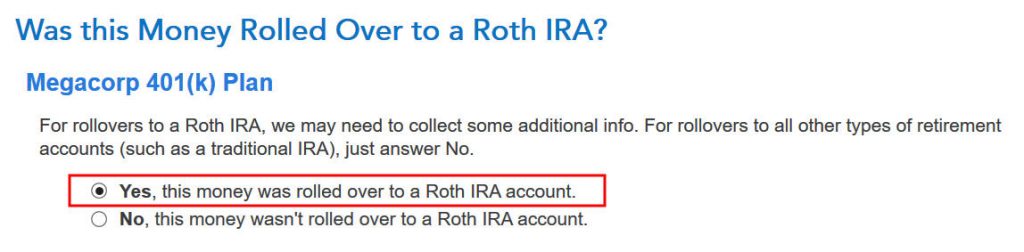

Confirm that the money went to a Roth IRA.

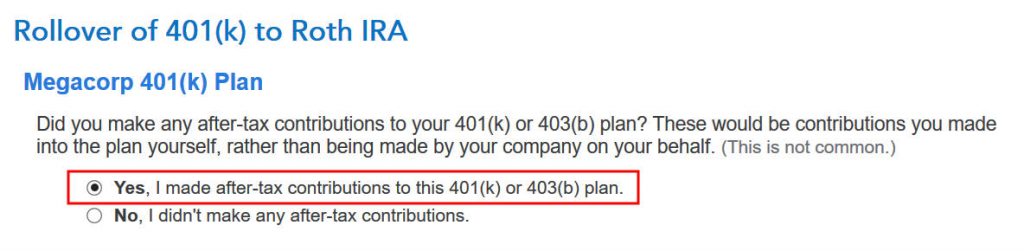

Confirm that you made after-tax non-Roth contributions.

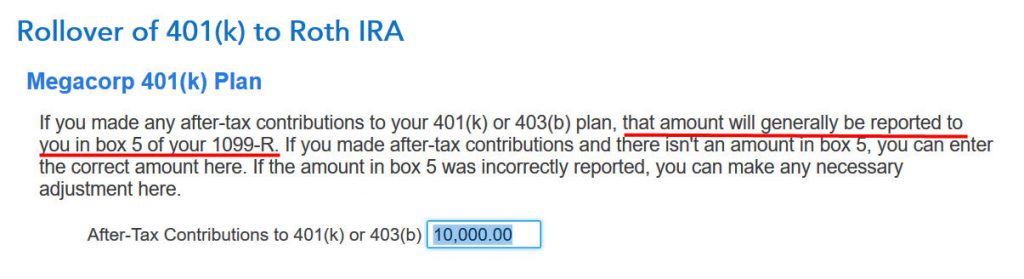

TurboTax pulls up your after-tax non-Roth contributions from box 5 of your 1099-R. If your 1099-R isn’t correct, you should work with your 401(k) administrator to have it corrected.

After this point, the interview follows the same path as converting to the Roth account within the plan. Please scroll up and follow there. I’m not repeating them here.

In the end, Form 1040 will show the same as converting within the plan. Line 5a includes the $10,200 gross distribution amount. Line 5b only includes the $200 taxable amount. With a Mega Backdoor Roth, you got an extra $10k into your Roth IRA. After paying tax on this $200, the future earnings on the $10,200 will be tax-free.

Comments

Post a Comment

https://gengwg.blogspot.com/